Once you have completed Final Trial Balance, you will have learn how to complete payments for contractual employee’s under SAGE Construction Industrial Scheme (CIS).

You will then cover Tax Level 1, where you would learn about how personal taxation works.

As all the courses are progressive courses. The Intermediated Level training includes all the course contents of Advanced Training

Candidates will receive a hands-on training and will know how to perform the following tasks:

In the Fundamental level training candidates gain knowledge uptill quarterly accounts & submission of VAT to HMRC.

In addition to tasks completed in Fundamental level, candidates have the opportunity to cover the following in Intermediate level training.

In the Fundamental level training candidates gain knowledge uptill quarterly accounts & submission of VAT to HMRC.

In addition to tasks completed in Fundamental level, candidates have the opportunity to cover the following in Intermediate level training.

This training package is everything you need to demonstrate your competency for the following roles:

Additional Content

KBM TR is proud to present specialized courses in Construction Industrial Scheme. Be a part of professional network and make your CV stand out with quality training.

In order to equip candidates with the knowledge of income tax computation and tax planning we have developed our income tax courses, which will give candidates the necessary skills and understanding of this topic.

By the end of the course with us you will learn the tax procedures as they should be applied in real life accountancy work.

The training was developed in such way, that candidates will gradually perform more and more complicated calculations This makes the course suitable for anyone.

This is a unique course which will in a few sessions cover the basics of UK income taxation. There will be plenty ofexercises with workings and explanations, and one to one support available too

Income Tax Course

Candidates have the opportunity to master a manual tax computation, candidates also have the opportunity to cover the following tasks:

A comprehensive training course with up to date material to practice at home and during your class. We will also provide a step by step manual of all the tricks you can do using Excel spreadsheets to gain better management reporting and budgeting skills.

Whether you're looking for a beginner, intermediate or advanced Excel training program, you won't be disappointed in the end result. You will learn valuable tips and tricks to improve your excel skills. Course contents:

In addition to the Sage 50, Quick Books, Excel Bookkeeping and Sage Payroll, you can also choose 2 additional software from a list of 11 different options.

| Level | Courses | Products | |

| 1 | Fundamental | Bookkeeping | Peach Tree |

| 2 | Fundamental | Bookkeeping | VT Books |

| 3 | Fundamental | Bookkeeping | IRIS BK |

| 4 | Fundamental | Bookkeeping | MYOB |

| 5 | Fundamental | Payroll | IRIS Payroll |

| 6 | Fundamental | Bookkeeping | TAS Books |

| 7 | Fundamental | Payroll | Excel Payroll |

| 8 | Fundamental | Payroll | Quick Books Payroll |

| 9 | Fundamental | Payroll | TAS Books Payroll |

| Level | Courses | Products | |

| 11 | Intermediate | Adv. Bookkeeping Cert. | OCR Level 2 |

| 12 | Intermediate | ERP Bookkeeping | TALLY |

| 13 | Intermediate | Tax | International Trade, UK & Foreign VAT |

| Level | Courses | Products | |

| 14 | Advanced | ERP Bookkeeping | SAP End User |

| 15 | Advanced | Accounts | VT Accounts |

Each training session has a few candidates delivered in a friendly and relaxing environment, which gives candidates the opportunity to ask questions and raise issues freely. You can be assured that you will receive one to one individual attention from our team.

Suitable for

The 6 Months Intermediate Training is ideal for:

| Time | Cost | Hours | Compulsory Modules | Optionals Modules | Allowed Options |

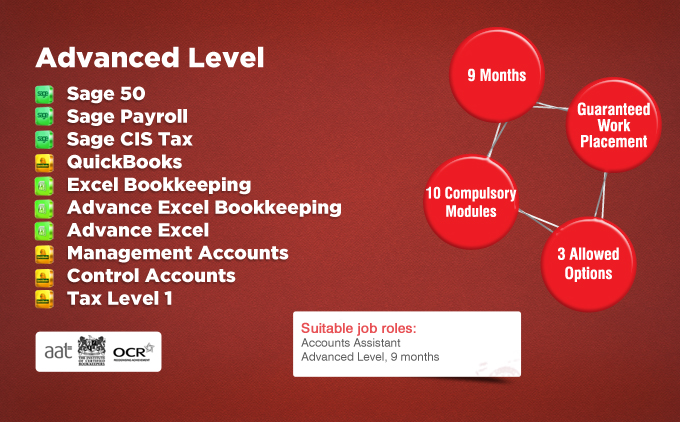

| 9 Months | £ 2,200 | 288 | 10 | 15 | 3 |

| Level | Courses | Products | Select one | |

| 1 | Fundamental | Bookkeeping | Peach Tree | |

| 2 | Fundamental | Bookkeeping | VT Books | |

| 3 | Fundamental | Bookkeeping | IRIS BK | |

| 4 | Fundamental | Bookkeeping | MYOB | |

| 5 | Fundamental | Bookkeeping | OCR Level 1 | |

| 6 | Fundamental | Payroll | IRIS Payroll | |

| 7 | Fundamental | Bookkeeping | TAS Books | |

| 8 | Fundamental | Payroll | Excel Payroll | |

| 9 | Fundamental | Payroll | Quick Books Payroll | |

| 10 | Fundamental | Payroll | TAS Books Payroll |