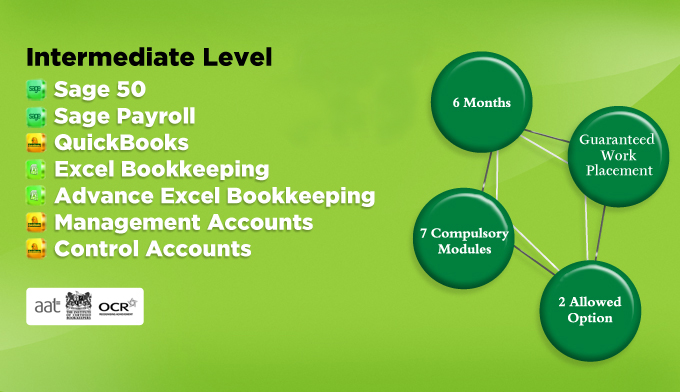

The 6 month Intermediate Level Training is highly popular with our candidates and is for those aiming to become an Accounts Assistant. Only six months and your competency is guaranteed. Our training is structured in such a way that it is suitable for both experienced and inexperienced candidates.

As all the courses are progressive courses. The Intermediated Level training includes all the course contents of Fundamental Training

Candidates will receive a hands-on training and will know how to perform the following tasks:

In the Fundamental level training candidates gain knowledge uptill quarterly accounts & submission of VAT to HMRC.

In addition to tasks completed in Fundamental level, candidates have the opportunity to cover the following in Intermediate level training.

This training package is everything you need to demonstrate your competency for the following roles:

In addition to the Sage 50, Quick Books, Excel Bookkeeping and Sage Payroll, you can also choose 2 additional software from a list of 11 different options.

| Level | Course | Products | |

| 1 | Fundamental | Bookkeeping | Peach Tree |

| 2 | Fundamental | Bookkeeping | VT Books |

| 3 | Fundamental | Bookkeeping | IRIS BK |

| 4 | Fundamental | Bookkeeping | TAS Books |

| 5 | Fundamental | Bookkeeping | MYOB |

| 6 | Fundamental | Payroll | IRIS Payroll |

| 7 | Fundamental | Payroll | Excel Payroll |

| 8 | Fundamental | Payroll | Quick Books Payroll |

| 9 | Fundamental | Payroll | TAS Books Payroll |

| 10 | Intermediate | Adv. Bookkeeping Cert. | OCR Level 2 |

Each training session has a few candidates delivered in a friendly and relaxing environment, which gives candidates the opportunity to ask questions and raise issues freely. You can be assured that you will receive one to one individual attention from our team.

Suitable for

The 6 Months Intermediate Training is ideal for:

| Time | Cost | Hours | Compulsory Modules | Optionals Modules | Allowed Options |

| 6 Months | £ 1,690 | 196 | 7 | 11 | 2 |

| Level | Course | Products | |

| 1 | Fundamental | Bookkeeping | QuickBooks |

| 2 | Fundamental | Bookkeeping | Sage 50 |

| 3 | Fundamental | Bookkeeping | Excel Bookkeeping |

| 4 | Intermediate | Bookkeeping | Advance Excel Bookkeeping |

| 5 | Fundamental | Payroll | Sage Payroll |

| 6 | Intermediate | Accounts | Management Accounts |

| 7 | Intermediate | Accounts | Control Accounts |